You value your economics textbook at $10. Someone else values it at $25, and that person is willing to pay you $20 for your textbook. Would selling your textbook to this person for $20 be Pareto efficient?

A. Yes, because both of you are better off as a result of the trade.

B. No, the person paid you $20 for the book so his net benefit was only $5, whereas your net benefit was $10. For this change to be Pareto efficient, each of you should have the same net benefit.

C. Yes, because even though you gain from the trade and he loses, there is the potential for you to compensate him for his loss.

D. No, because you did not receive the maximum amount the other person would have been willing to pay for the textbook.

Answer: A

You might also like to view...

A perfectly competitive firm is producing 50 units of output, which it sells at the market price of $23 per unit. The firm's average total cost is $20. What is the firm's total revenue?

A) $23 B) $150 C) $1,000 D) $1,150 E) $20

Using the above figure, during which month was the price for crude oil the highest?

A) July B) December C) May D) October

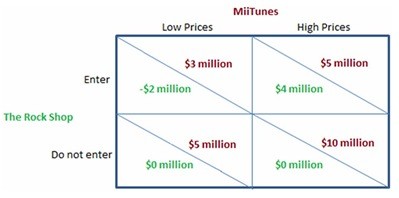

This figure displays the choices and payoffs (company profits) of two music shops-MiiTunes and The Rock Shop. MiiTunes is an established business in the area deciding whether to charge its usual high prices or to charge very low prices, in the hopes that a new business will not be able to make a profit at such low prices. The Rock Shop is trying to decide whether or not it should enter the market and compete with MiiTunes.According to the figure, if MiiTunes charges low prices, The Rock Shop should:

This figure displays the choices and payoffs (company profits) of two music shops-MiiTunes and The Rock Shop. MiiTunes is an established business in the area deciding whether to charge its usual high prices or to charge very low prices, in the hopes that a new business will not be able to make a profit at such low prices. The Rock Shop is trying to decide whether or not it should enter the market and compete with MiiTunes.According to the figure, if MiiTunes charges low prices, The Rock Shop should:

A. enter the market and lose $2 million. B. enter the market and earn $4 million. C. not enter the market and earn $0. D. It cannot be determined what The Rock Shop will do.

Assume that the required reserve ratio for the commercial banks is 25 percent. If the Federal Reserve Banks buy $3 billion in government securities from the non-bank securities dealers, then as a result of this transaction, the lending ability of the commercial banking system will increase by:

A. $4.5 billion B. $9 billion C. $12 billion D. $15 billion