Give the quadrant in which the point is located.(5, 12)

A. Quadrant II

B. Quadrant I

C. Quadrant IV

D. Quadrant III

Answer: B

You might also like to view...

Determine the indicated term of the given recursively defined sequence.a1 = 4, a2 = 12, ak+2 = ak+1 + 8; a4

A. 12 B. 20 C. 36 D. 28

The present values of ordinary annuities, annuities due, and deferred annuities were discussed in the textbook. Discuss the ways these three annuities are similar and dissimilar.

What will be an ideal response?

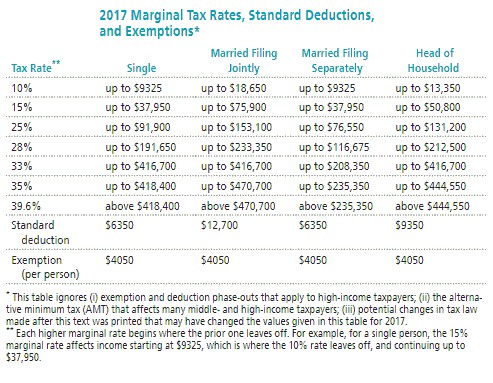

Solve the problem. Refer to the table if necessary. Abbey earned $67,862 in wages. Kathryn earned $67,862, all in dividends and long-term capital gains. Calculate the total tax owed by each, including both FICA and income taxes. Assume they are both single and take the standard deduction. Note that long-term capital gains and dividends are taxed at 0% for income in the 10% and 15% tax brackets and at 15% for income in all higher tax brackets except the highest 39.6% bracket. If necessary, round values to the nearest dollar.

Abbey earned $67,862 in wages. Kathryn earned $67,862, all in dividends and long-term capital gains. Calculate the total tax owed by each, including both FICA and income taxes. Assume they are both single and take the standard deduction. Note that long-term capital gains and dividends are taxed at 0% for income in the 10% and 15% tax brackets and at 15% for income in all higher tax brackets except the highest 39.6% bracket. If necessary, round values to the nearest dollar.

A. Abbey: $15,569 Kathryn: $4878 B. Abbey: $14,531 Kathryn: $8153 C. Abbey: $10,104 Kathryn: $2927 D. Abbey: $15,296 Kathryn: $2927

Solve.Determine how much of the total loan payment applies toward principal and how much applies toward interest for a home mortgage of $136,538 with a fixed APR of 4.4% for 15 years.

A. $136,538 pays off the principal and $50,340.10 represents interest payments. B. $136,538 pays off the principal and $50,267.78 represents interest payments. C. $136,538 pays off the principal and $50,185.10 represents interest payments. D. $136,538 pays off the principal and $50,219.55 represents interest payments.