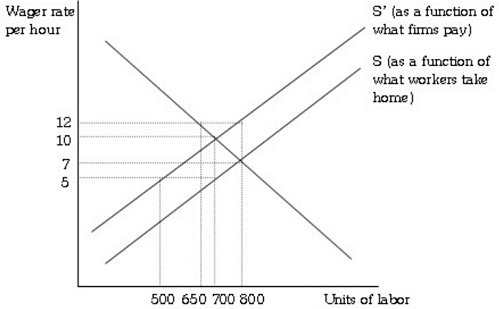

Refer to the information provided in Figure 19.1 below to answer the question(s) that follow.  Figure 19.1 Refer to Figure 19.1. Prior to the imposition of the payroll tax, this labor market ________ at a wage of $7.00 and employment of 800 workers.

Figure 19.1 Refer to Figure 19.1. Prior to the imposition of the payroll tax, this labor market ________ at a wage of $7.00 and employment of 800 workers.

A. was employing too many workers

B. was in equilibrium

C. was paying too high a wage rate

D. was employing too few workers

Answer: B

You might also like to view...

Lora earns an income of $7,500 per month. Under the federal income tax system, the first $6,000 she earns is taxed at 10% and the remaining income is taxed at 20%. Then the average tax paid by Lora equals _____

a. 25 percent b. 12 percent c. 30 percent d. 20 percent

Other things the same, a government budget deficit

a. reduces public saving, but not national saving. b. reduces national saving, but not public saving. c. reduces both public and national saving. d. reduces neither public saving nor national saving.

Which of the following is an example of a change in derived demand?

A. The demand for ice cream increases during a heat wave. B. The demand for large pickup trucks falls when the price of gasoline increases. C. The demand for buns increases when the price of food truck hot dogs increases. D. The demand for sunscreen falls when the local swimming pool increases prices.

Goods and services of value to households are

A. outputs in the production process. B. both inputs and outputs in the production process. C. inputs in the production process. D. unrelated to the production process.