If output falls 1.0 percentage point below its potential, the Taylor rule predicts that the Fed should:

A. reduce the federal funds rate by 0.5 percentage points.

B. raise the federal funds rate by 1.0 percentage points.

C. raise the federal funds rate by 1.5 percentage points.

D. reduce the federal funds rate by 1.0 percentage points.

Answer: A

You might also like to view...

A competitive market is in equilibrium. Bagels and cream cheese are complementary goods. Suppose that the price for flour, which is used to produce bagels, increases. The equilibrium price of cream cheese ________, and the equilibrium quantity of cream cheese ________.

A) rises; decreases

B) rises; increases

C) falls; decreases

D) does not change; does not change

E) falls; increases

If money demand does not depend on the interest rate then

a. the LM curve if vertical and fiscal policy is ineffective. b. the LM curve is horizontal and fiscal policy is ineffective. c. the LM curve is horizontal and horizontal has no effect on output. d. the LM curve is vertical and monetary policy is ineffective.

The Federal Reserve (Fed) was criticized for playing a role in causing the Great Recession. Which of the following criticisms most accurately captures this criticism?

a. The Fed kept monetary policy loose for too long, thereby fueling speculation in the housing market. b. The Fed kept monetary policy too tight immediately after the 2001 recession and then loosened it just prior to the recession, thereby precipitating the crisis. c.The Fed relaxed banking regulations after the 2001 recession, causing banks and other financial institutions to engage in speculative activities for which they were unprepared. d. The Fed encouraged home ownership by putting pressure on Fannie Mae and Freddie Mac.

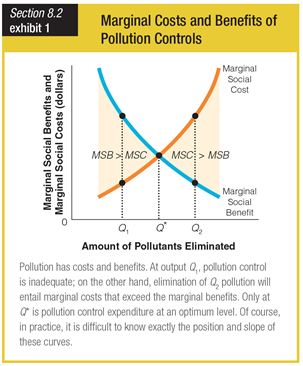

In this graph for the marginal costs and benefits of pollution controls, at output level Q*, pollution control is ______.

a. unnecessary

b. optimized

c. insufficient

d. excessive