If the Fed buys U.S. government bonds from the public, it

A) increases the volume of reserves in the banking system and the money supply tends to grow.

B) decreases the volume of reserves in the banking system and the money supply tends to grow.

C) increases the volume of reserves in the banking system and the money supply tends to fall

D) decreases the volume of reserves in the banking system and the money supply tends to fall.

Answer: A) increases the volume of reserves in the banking system and the money supply tends to grow.

You might also like to view...

The one type of expenditure that we assume can differ from what spenders have planned is

A) consumption. B) investment. C) government expenditure. D) net exports.

The initial Phillips curve relationship implied that the opportunity cost of _____ was higher _____

a. reducing unemployment; inflation b. increasing unemployment; inflation c. decreasing employment; interest rate d. increasing employment; deflation e. increasing employment; interest rate

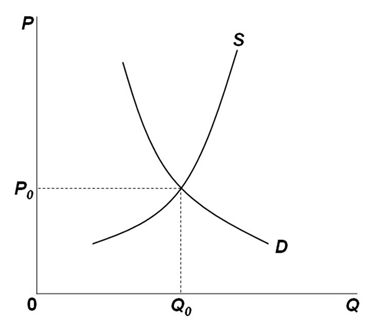

If the supply and demand curves below represent the market supply and demand for a purely competitive industry, then the demand curve that an individual firm in the industry faces:

A. Is identical to the market demand

B. Is equal to the marginal-revenue curve which is a flat line at P0

C. Is more elastic than the market demand but has a marginal-revenue curve lying below it

D. Has the same slope as the market demand, but at P0 its quantity demanded is only a fraction of Q0

Assume the marginal propensity to consume is 0.8. If consumer spending increases by $20 billion, then real GDP will:

A. Increase by $100 billion B. Decrease by $100 billion C. Increase by $16 billion D. Will not change