The ability of one person or nation to produce a good at a lower absolute cost than another is called a(n):

A. market advantage.

B. comparative advantage.

C. absolute advantage.

D. specialization advantage.

Answer: C

You might also like to view...

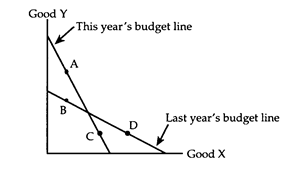

Consider an income tax and a head tax, the sizes of which have been set so that the government collects the same amount of money under each tax. Which tax does the consumer prefer?

a. The consumer is indifferent between the two taxes, since he pays the same amount of money under each tax.

b. The consumer prefers the head tax, because it does not lower the relative wage as does the income tax.

c. The consumer prefers the income tax, because it can be avoided by increasing the amount of leisure time consumed.

d. The consumer may prefer either tax, depending on whether the income tax increases or decreases the number of hours of work at the optimum.

Consumers' total benefit from consuming a good is equal to the

A) total amount spent on the good. B) consumer surplus on the quantity purchased. C) consumer surplus plus the total amount spent on the good. D) consumer surplus minus the total amount spent on the good. E) total amount spent on the good divided by the number of units purchased.

Demand-pull inflation results from continually increasing the quantity of money, which leads to continually

A) decreasing potential GDP. B) increasing potential GDP. C) increasing aggregate supply. D) decreasing aggregate demand. E) increasing aggregate demand.

Pay-As-You-Throw programs that charge people a small price for each bag of trash they throw out are likely to ________

A) increase waste creation B) increase recycling and reuse C) increase the social cost of waste disposal D) reduce social surplus