On September 1, 2014, Watson Company received a loan of $44,940 from One Finance Company. To pay off this loan, Watson Company will have to pay One Finance $10,000 each year for ten years. The first payment is due September 1, 2015. Which interest rate compounded annually is Watson paying on this loan?

A. 12%

B. 15%

C. 18%

D. 24%

Answer: C

You might also like to view...

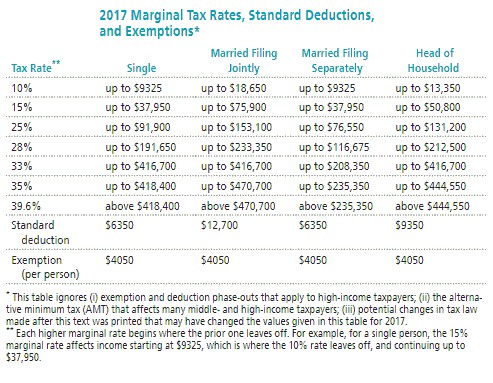

Solve the problem. Refer to the table if necessary. Abbey earned $67,862 in wages. Kathryn earned $67,862, all in dividends and long-term capital gains. Calculate the total tax owed by each, including both FICA and income taxes. Assume they are both single and take the standard deduction. Note that long-term capital gains and dividends are taxed at 0% for income in the 10% and 15% tax brackets and at 15% for income in all higher tax brackets except the highest 39.6% bracket. If necessary, round values to the nearest dollar.

Abbey earned $67,862 in wages. Kathryn earned $67,862, all in dividends and long-term capital gains. Calculate the total tax owed by each, including both FICA and income taxes. Assume they are both single and take the standard deduction. Note that long-term capital gains and dividends are taxed at 0% for income in the 10% and 15% tax brackets and at 15% for income in all higher tax brackets except the highest 39.6% bracket. If necessary, round values to the nearest dollar.

A. Abbey: $15,569 Kathryn: $4878 B. Abbey: $14,531 Kathryn: $8153 C. Abbey: $10,104 Kathryn: $2927 D. Abbey: $15,296 Kathryn: $2927

Decide whether the statement makes sense. Explain your reasoning.The two accounts were offering the same APR, and both accounts had the same annual percentage yield, but one account compounded interest continuously while the other compounded interest daily.

What will be an ideal response?

Provide an appropriate response.What type of spending is easiest for the government to control?

A. Entitlement spending B. Discretionary spending C. Medicare D. Interest payments on the debt

Use the Half-angle Formulas to find the exact value of the trigonometric function. tan 75°

A. -2 +

B. -2 -

C. 2 +

D. 2 -