A firm is considering entering a market where demand for its product is Q = 100 - P. This demand function implies that the firm’s marginal revenue function is MR = 100 - 2Q. The firm’s total cost of producing the product for that market is TC = 500 + 10Q + Q2 which indicates that its marginal cost function is MC = 10 + Q. Indicate whether or not the firm should enter the market by calculating the firm’s profit (Hint: to find the price that the firm should charge, take the profit maximizing quantity and plug it into the demand equation). Describe how your previous answer would change if the firm’s total cost function became TC = 1000 + 10Q + Q2.

What will be an ideal response?

A firm is considering entering a market where demand for its product is Q = 100 - P. This demand function implies that the firm’s marginal revenue function is MR = 100 - 2Q. The firm’s total cost of producing the product for that market is TC = 500 + 10Q + Q2 which indicates that its marginal cost function is MC = 10 + Q. Indicate whether or not the firm should enter the market by calculating the firm’s profit (Hint: to find the price that the firm should charge, take the profit maximizing quantity and plug it into the demand equation). Describe how your previous answer would change if the firm’s total cost function became TC = 1000 + 10Q + Q2.

You might also like to view...

With an average cost pricing rule, the quantity produced by the natural monopoly is ________ the quantity produced with a marginal cost pricing rule

A) greater than B) less than C) equal to D) greater than in the long run and less than in the short run than E) not comparable to

The Laffer Curve indicates that

a. when tax rates are high, a rate reduction may lead to an increase in tax revenue. b. when tax rates are low, an increase in tax rates will generally lead to a reduction in tax revenues. c. an increase in tax rates will always lead to an increase in tax revenues. d. the deadweight losses resulting from taxation are small at the tax rate that maximizes the revenues derived by the government.

When tax code changes increase investment incentives, the _____ for loanable funds curve shifts to the _____. This results in a(n) _____ in the interest rate and a(n) _____ in investment

Fill in the blank(s) with correct word

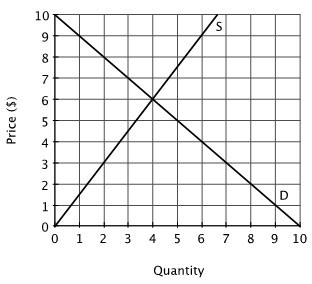

Refer to the accompanying figure. If the price is $4 today and there is no change in either supply or demand, one would expect the price in the future to be:

A. less than $4. B. greater than $4. C. greater than $6. D. $4.