Exhibit 20-5 The Baltimore, Inc entered into a five-year lease with the Waugh Chapel Company on January 1, 2016. Baltimore, the lessor, will require that five equal annual payments of $25,000 be made at the beginning of each year. The first payment will be made on January 1, 2016. The lease contains a bargain purchase option price of $12,000, which the lessee may exercise on December 31, 2020

The lessee pays all executory costs. The cost of the leased property and its normal selling price are $95,000 and $118,236, respectively. Collectibility of the future lease payments is reasonably assured, and the lessor does not expect to incur any future costs related to the lease. Present value factors for a 7% Present value of $1 for n = 1 0.934579 Present value of $1 for n = 5 0.712986 Present value of an ordinary annuity for n = 5 4.100197 Present value of an annuity due for n = 5 4.387211 ? Refer to Exhibit 20-5. If Baltimore requires a 7% annual return, what is the correct amount that should be credited to Unearned Interest: Leases on January 1, 2016, by Baltimore (round the answer to the nearest dollar)?

A) $15,320

B) $18,764

C) $22,495

D) $43,236

B

You might also like to view...

Marketing research has often been described as having four stakeholders. These stakeholders have certain responsibilities to each other and to the research project. Which of the following is not one of the stakeholders?

A) the marketing researcher B) the respondent C) the public D) the environment

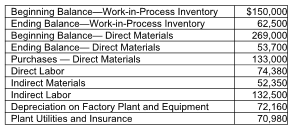

How much is the cost of goods manufactured?

Arturo Manufacturing, Inc. provided the following information for the year:

A) $838,170

B) $750,670

C) $900,670

D) $766,010

List the four key marketing strategies that can be employed to reshape demand

What will be an ideal response?

Choose the correct verb in parentheses. We (accept, except, expect) a big crowd at tonight's game