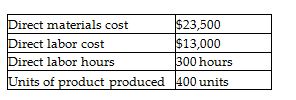

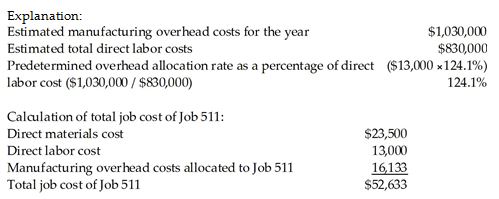

Gill Manufacturing uses a predetermined overhead allocation rate based on direct labor cost. At the beginning of the year, Gill estimated total manufacturing overhead costs at $1,030,000 and total direct labor costs at $830,000. In June, Gill completed Job 511. The details of Job 511 are shown below.

How much was the total job cost of Job 511? (Round any percentages to two decimal places and your final answer to the nearest dollar.)

A) $36,872

B) $52,633

C) $65,664

D) $36,996

B) $52,633

You might also like to view...

Scott Company sells merchandise with a one-year warranty. Sales consisted of 2,500 units in Year 1 and 2,000units in Year 2 . It is estimated that warranty repairs will average $10 per unit sold, and 30% of the repairs will bemade in Year 1 and 70% in Year 2 for the Year 1 sales. Similarly, 30% of repairs will be made in Year 2 and 70%in Year 3 for the Year 2 sales. In the Year 3 income

statement, how much of the warranty expense shown will bedue to Year 1 sales? a. $6,000. b. $14,000. c. $20,000. d. $0.

The three major categories of premiums are contests and sweepstakes, consumer premiums, and dealer premiums.

Answer the following statement true (T) or false (F)

Which of the following population groups is the most techno-savvy?

A. Gen X B. seniors C. Gen Y D. Baby Boomers

The accrual method recognizes revenue at the point of sale and recognizes expenses when incurred

Indicate whether the statement is true or false