Which of the following is not consistent with a goal of reducing the power of firms in the market?

a. shortening patent life

b. creative destruction theory

c. countervailing power theory

d. Schumpeter's economies of scale argument

e. antitrust policy

D

You might also like to view...

Mary Jane is willing to babysit for $6 an hour. Her neighbor has asked her to babysit for $8 an hour. Assuming Mary Jane accepts the offer:

A. her accounting profit will be $8 per hour, and her economic profit will be $0 per hour. B. her economic rent will be $2 per hour. C. her consumer surplus will be $2 per hour. D. her economic profit will be $8 per hour.

Income taxes tend to be favored over sales taxes _____

a. because of the excess burden on income taxes b. on the benefit principle c. on equity grounds d. as long as income as defined using the Haig-Simons definition

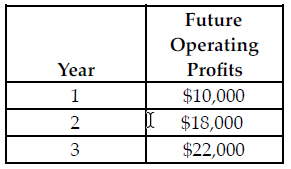

Refer to the table below. If the discount rate is 5 percent and the cost of the investment is $42,000, what is the net present value of the investment?

The above table shows the future operating profits from an investment. The future operating profits are earned at the end of each of the respective years.

A) $44,854.77

B) $2,854.77

C) $3,599.22

D) $42,464.22

Abby, Bobbi, and Deborah each buy ice cream and paperback novels to enjoy on hot summer days. Ice cream costs $5 per gallon, and paperback novels cost $8 each. Abby has a budget of $80, Bobbi has a budget of $60, and Deborah has a budget of $40 to spend on ice cream and paperback novels. Who can afford to purchase 4 gallons of ice cream and 5 paperback novels?

a. Abby, Bobbi, and Deborah b. Abby only c. Abby and Bobbi, but not Deborah d. None of the women can afford to purchase 4 gallons of ice cream and 5 paperback novels.