Philosophical ethics distinguishes what people do value from what they should value.

Answer the following statement true (T) or false (F)

True

You might also like to view...

Errors in the work sheets may result from incorrectly extending adjustments

Indicate whether the statement is true or false

In an internal transfer, the buying division records the transaction by

a. debiting Accounts Receivable. b. crediting Accounts Payable. c. debiting Intracompany Cost of Goods Sold. d. crediting Inventory.

Although he is aware that Greg's performance over the past year has not been quite up to standards, Jimmy, his superior, left the impression on Greg after a performance appraisal interview that he is doing a great job and to keep up the good work. Jimmy has a problem with

A. pointing out flaws in people. B. verbally communicating with people. C. discussing negative aspects of appraisals that may cause some discomfort for both parties. D. being honest with people. E. seeing the negative side of people because he is very optimistic and only sees good in people.

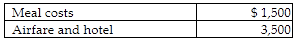

Having recently been to a company seminar on tax laws, Steven makes sure that business is discussed at the various meals. Steven is reimbursed $2,000 by his employer under an accountable plan. Steven's AGI for 2018 is $50,000, and he does itemize deductions. For tax purposes, how will Steven treat the $2,000 partial reimbursement and the $2,500 of unreimbursed expenses?

Steven is a representative for a textbook publishing company. Steven attends a convention which will also be attended by many potential customers. During the week of the convention, Steven incurs the following costs in attending the conference and taking potential customers to lunch and dinner to discuss book sales.

A) Reimbursement-exclude from income; unreimbursed expenses-no deduction allowed

B) Reimbursement-exclude from income; unreimbursed expenses-deduct within itemized deductions, after 50% reduction for meal portion

C) Reimbursement-include in income; unreimbursed expenses-no deduction allowed

D) Reimbursement-include in income; unreimbursed expenses-deduct within itemized deductions, after 50% reduction for meal portion