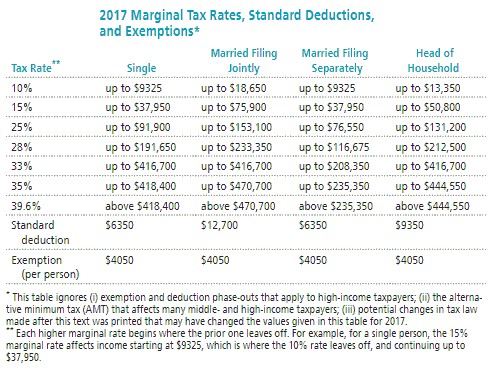

Solve the problem. Refer to the table if necessary. Jeff earned wages of

Jeff earned wages of  received

received  in interest from a savings account, and contributed

in interest from a savings account, and contributed  to a tax deferred retirement plan. He was entitled to a personal exemption of

to a tax deferred retirement plan. He was entitled to a personal exemption of

style="vertical-align: -4.0px;" /> and had deductions totaling  Find his taxable income.

Find his taxable income.

A. $46,588

B. $57,740

C. $38,488

D. $65,418

Answer: C

You might also like to view...

For the given principal, interest rate, and time period, determine the amount of interest that would be earned in an account paying simple interest. Also determine the amount of interest that would be earned in an account paying compound interest with interest compounded annually. Determine how much more interest would be earned in the account paying compound interest. Round to the nearest cent.Principal: $810 Rate: 4% Years: 17

A. $1027.00 B. $476.20 C. $217.00 D. $188.71

Solve the problem. Refer to the table if necessary. Kelly earned wages of

Kelly earned wages of  received

received  in interest from a savings account, and contributed

in interest from a savings account, and contributed  to a tax deferred retirement plan. She was entitled to a personal exemption of

to a tax deferred retirement plan. She was entitled to a personal exemption of

style="vertical-align: -4.0px;" /> and had deductions totaling  Find her gross income.

Find her gross income.

A. $84,228

B. $97,051

C. $103,220

D. $109,389

Find the infinite sum, if possible.

A. -

B.

C. not possible

D.

Find the exact value of the expression.cos  cos

cos  + sin

+ sin  sin

sin

A.

B.

C.

D. 1