A common application for centrifugal compressors is:

A) Industrial process chilling. B) Low temperature, commercial refrigeration.

C) Residential split systems. D) Small appliances.

A

You might also like to view...

How do we determine when components need preventative maintenance?

What will be an ideal response?

A ground fault circuit interrupter (GFCI) is designed to

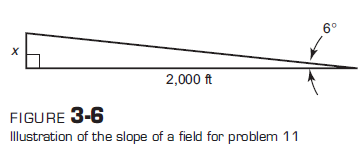

A field has a 6° drop on the horizontal in ,000 feet. Find the vertical distance (x) in Figure 3-6.

The president of ChemTech is trying to decide whether to start a new product line or purchase a small company. It is not financially possible to do both. To make the product for a 3-year period will require an initial investment of $250,000. The expected annual cash flows with probabilities in parentheses are $75,000 (0.5), $90,000 (0.4), and $150,000 (0.1). To purchase the small company will cost $450,000 now. Market surveys indicate a 55% chance of increased sales for the company and a 45% chance of severe decreases with an annual cash flow of $25,000. If decreases are experienced in the first year, the company will be sold immediately (during year 1) at a price of $200,000. Increased sales could be $100,000 the first 2 years. If this occurs, a decision to expand after 2 years at an

additional investment of $100,000 will be considered. This expansion could generate cash flows with indicated probabilities as follows: $120,000 (0.3), $140,000 (0.3), and $175,000 (0.4). If expansion is not chosen, the current size will be maintained with anticipated sales to continue. Assume there are no salvage values on any investments. Use the description given and a 15% per year return to do the following: (a) Construct a decision tree including all values and probabilities. (b) Determine the expected PW values at the “expansion/no expansion” decision node after 2 years provided sales are up. (c) Determine what decision should be made now to offer the greatest return possible for ChemTech. (d ) Explain in words what would happen to the expected values at each decision node if the planning horizon were extended beyond 3 years and all cash flow values continued as forecasted in the description.