Which, if any, of the following expenses is subject to the 2%-of-AGI floor?

a. Qualified tuition expenses under § 222.

b. Contribution to traditional IRA.

c. Cost of a CPA exam review course—taxpayer just began employment with an accounting firm.

d. Office in the home deduction for a self-employed taxpayer.

e. None of these.

Ans: e. None of these.

You might also like to view...

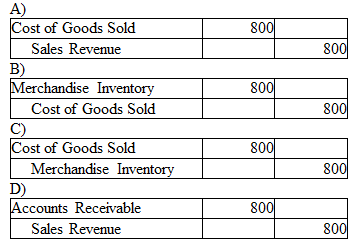

A company that uses the perpetual inventory system sold goods for $2,400 to a customer on account. The company had purchased the inventory for $800. Which of the following journal entries correctly records the cost of goods sold? A

________ can be defined as a deeply held commitment to rebuy or repatronize a preferred product or service in the future despite situational influences and marketing efforts having the potential to cause switching behavior

A) Value proposition B) Loyalty C) Satisfaction D) Respect E) Customer value

The staffing of an organization is considered part of which management function?

a. organizing b. controlling c. planning d. leading

According to the Principle of Veracity, lying would be justified in which situation?

A. during a poker game B. to trick a criminal suspect into a confession C. to save a life D. all of these