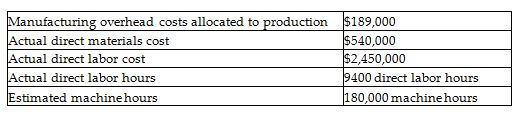

Q-dot Manufacturing uses a predetermined overhead allocation rate based on direct labor hours. It has provided the following information for the year:

Based on the above information, calculate Q-dot's predetermined overhead allocation rate. (Round your answer to two decimal places.)

A) $1.05 per machine hour

B) 7.71% of direct labor cost

C) 35.00% of direct materials cost

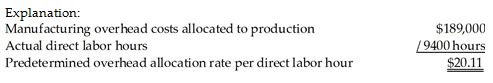

D) $20.11 per direct labor hour

D) $20.11 per direct labor hour

You might also like to view...

When using the direct method, how is the issuance of stock for cash shown on the statement of cash flows?

a. Operating activity b. Investing activity c. Financing activity d. Noncash investing and financing activity

Explain total customer satisfaction

What will be an ideal response?

The normal balance of a capital account is a debit

Indicate whether the statement is true or false

Given the comprehensive nature of the federal consumer protection legislation, what purpose is served by parallel state legislation?

What will be an ideal response?