Which of the following is correct? When the actual amount supplied exceeds the actual amount demanded, then:

a. Inventories rise, unemployment tends to rise, and prices tend to fall.

b. Inventories rise, unemployment tends to fall, and prices tend to rise.

c. Inventories fall, unemployment tends to rise, and prices tend to rise.

d. It is impossible for these two to be unequal.

e. The nation falls into an economic recession.

.D

You might also like to view...

The Haig-Simons definition of income includes

A. employer pension contributions and insurance purchases. B. transfer payments. C. income in-kind. D. all of these answer options are correct.

The nominal interest rate is:

A. the everyday notion of the interest rate adjusted for inflation. B. the reported interest rate, adjusted for the effects of inflation. C. the amount of interest the bank charges you for saving or pays you for borrowing. D. the amount of interest the bank pays you for saving or charges you for borrowing.

The Hatfields and the McCoys both earn $50,000 per year in real terms in the labor market, and both families are able to earn a 25 percent real interest rate on their savings. Assume that all interest is paid out as income in the following year. In the year 2010, both families began to save. The Hatfields saved 8 percent of their income each year; the McCoys saved 10 percent. In 2010, the Hatfields consumed ________ more than the McCoys; in 2011, the Hatfields consumed ________ than the McCoys.

A. $1,000; about $800 less B. $1,000; about $800 more C. $2,000; about $250 less D. $2,000; about $250 more

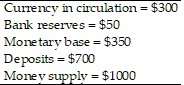

Consider an economy that has the following monetary data. The monetary base and the money supply are expected to grow at a constant rate of 20% per year. Inflation and expected inflation are 20% per year. Suppose that bank reserves and currency pay no interest, all currency is held by the public, and bank deposits pay no interest.(a)What is the cost to the public of the inflation tax?(b)What is the nominal value of seignorage over the year?(c)What is the profit to the banks from the inflation?

The monetary base and the money supply are expected to grow at a constant rate of 20% per year. Inflation and expected inflation are 20% per year. Suppose that bank reserves and currency pay no interest, all currency is held by the public, and bank deposits pay no interest.(a)What is the cost to the public of the inflation tax?(b)What is the nominal value of seignorage over the year?(c)What is the profit to the banks from the inflation?

What will be an ideal response?