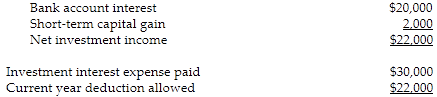

What is Phoebe's investment interest expense deduction for the year, assuming no special elections are made?

Phoebe's AGI for the current year is $140,000. Included in this AGI is $100,000 salary, $20,000 of interest income earned on bank accounts, $12,000 of dividend income, a short-term capital gain of $2,000 and a long-term capital gain of $6,000. In earning the investment income, Phoebe paid investment interest expense of $30,000.

Investment income included in net investment income:

$8,000 is carried over and deducted in a subsequent year.

You might also like to view...

When you receive an e-mail written in all caps with lots of exclamation points, the tone of the message is changed. The change in tone is a characteristic of what type of communication?

a. verbal b. nonverbal c. non-professional d. computer-mediated

The computer processes data through output devices.

Answer the following statement true (T) or false (F)

The writer of a long report that contains many ideas and sections will likely benefit from

a. the preparation of a planning outline. b. the development of a list of jargon to be included. c. the elimination of objective terms. d. All of the above.

The strength of using ______ is that the HR staff and developers can focus specifically on business processes, policies, and procedures instead of on technology, leading to stronger solutions.

a. gap analysis b. the needs analysis c. the physical model d. the logical model