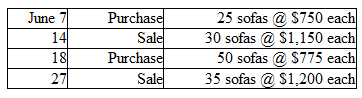

Modern Lifestyle Furniture began June with merchandise inventory of 45 sofas that cost a total of $31,500. During the month, Modern purchased and sold merchandise on account as follows:

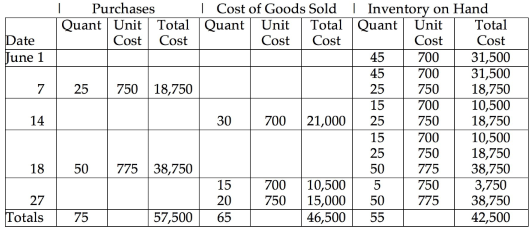

Prepare a perpetual inventory record, using the FIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit.

Gross Profit = Sales - Cost of Goods Sold

Gross Profit = $76,500 - $46,500 = $30,000

Sales = (30 × $1,150) + (35 × $1,200) = $76,500

You might also like to view...

SCENARIO-BASED QUESTIONS Developing a Professional Profile An increasing number of job applicants are developing an electronic portfolio that is posted on the applicants' personal website. Austin McClain is a recent graduate with an MBA degree in

accounting. He needs to write a professional profile for his electronic portfolio that highlights his accomplishments that include the following: Austin wants to work with the first-year audit staff in a large international accounting firm. He has an auditing experience resulting from a summer internship with a Dallas accounting firm. He has the required knowledge and skill to use the ERP systems, ACL, database, and spreadsheet software. Austin is fluent in Spanish, which will be advantageous while working with international clients. As a student, he has been active in Beta Alpha Psi, the honorary accounting society, and several other organizations, where he held leadership positions. He has strong written and verbal communication skills. Required: Write a professional profile for Austin McClain suitable for posting on his electronic portfolio.

Statutes of repose places outer times limit on product liability actions

Indicate whether the statement is true or false

In the context of departmentalization, dividing employees into groups based on the type of work they do is known as _____.

A. process departmentalization B. geographical departmentalization C. product departmentalization D. customer departmentalization

Gehlhausen Corporation has provided the following financial data:Balance SheetDecember 31, Year 2 and Year 1AssetsYear 2Year 1Current assets: Cash$110,000 $160,000 Accounts receivable, net 256,000 250,000 Inventory 205,000 200,000 Prepaid expenses 33,000 30,000 Total current assets 604,000 640,000 Plant and equipment, net 784,000 730,000 Total assets$1,388,000 $1,370,000 Liabilities and Stockholders' Equity Current liabilities: Accounts payable$124,000 $140,000 Accrued liabilities 85,000 80,000 Notes payable, short term 57,000 50,000 Total current liabilities 266,000 270,000 Bonds payable 260,000 260,000 Total liabilities 526,000 530,000 Stockholders' equity: Common stock, $5 par

value 400,000 400,000 Additional paid-in capital 100,000 100,000 Retained earnings 362,000 340,000 Total stockholders' equity 862,000 840,000 Total liabilities & stockholders' equity$1,388,000 $1,370,000 Income StatementFor the Year Ended December 31, Year 2Sales (all on account)$1,310,000 Cost of goods sold 710,000 Gross margin 600,000 Operating expenses 538,538 Net operating income 61,462 Interest expense 19,000 Net income before taxes 42,462 Income taxes (35%) 14,862 Net income$27,600 Dividends on common stock during Year 2 totaled $5,600. The market price of common stock at the end of Year 2 was $5.60 per share.Required:a. What is the company's net profit margin percentage for Year 2?b. What is the company's gross margin percentage for Year 2?c. What is the company's return on total assets for Year 2?d. What is the company's return on equity for Year 2? What will be an ideal response?