Which of the following statements about organizational forms for conducting foreign operations is false?

A. Income from foreign operations conducted through a foreign subsidiary is reported on the consolidated U.S. income tax return.

B. Income from a foreign branch office is reported on the consolidated U.S. income tax return.

C. Income from foreign operations conducted through a domestic subsidiary is reported on the consolidated U.S. income tax return.

D. Dividends received by a U.S. multinational corporation from a foreign subsidiary are reported on the consolidated U.S. income tax return.

Answer: A

You might also like to view...

Using linear organization in writing allows which of the following benefits to readers on mobile devices?

A) Information flows from top to bottom to simplify reading. B) The most important information is first followed by addition layers of detail. C) An executive summary is offered with more detail available on a PC. D) Embedded links to additional information if desired E) Less intimidating paragraphs

What type of research would be the most useful to determine if a 20-percent decrease in price for a high-end sedan would result in an increase in purchases sufficient to offset the reduced price? Why?

What will be an ideal response?

In Furrer, Thomas and Goussevskaia’s research, the most frequent keyword associated with strategy was:

a. Process b. Dynamics c. Performance d. Environment

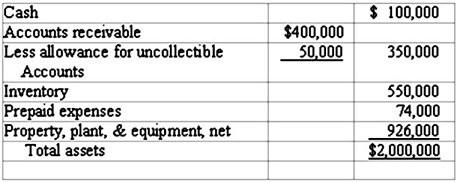

Longwood Company had a current ratio of 3:1 at the end of Year 1. The asset section of the company's balance sheet is provided below: Required:1) Compute Longwood Company's end-of-year working capital.2) Compute the company's quick (acid-test) ratio.3) The company has a debt agreement with its bank that authorizes the bank to call in its loan to the company if the company's current ratio falls below 3:1 as of the last day of any month during the term of the loan. During January Year 2, the company engaged in the three following transactions:(a) Collected $100,000 on account;(b) Purchased inventory on account, $50,000(c) Paid accounts payable, $60,000Will

Required:1) Compute Longwood Company's end-of-year working capital.2) Compute the company's quick (acid-test) ratio.3) The company has a debt agreement with its bank that authorizes the bank to call in its loan to the company if the company's current ratio falls below 3:1 as of the last day of any month during the term of the loan. During January Year 2, the company engaged in the three following transactions:(a) Collected $100,000 on account;(b) Purchased inventory on account, $50,000(c) Paid accounts payable, $60,000Will

the company be in default after completing these transactions? Justify your answer.Round your answers to two decimal places. What will be an ideal response?