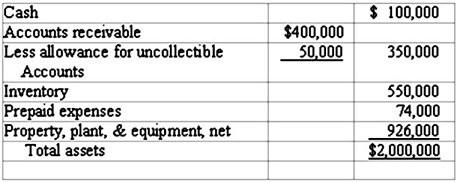

Longwood Company had a current ratio of 3:1 at the end of Year 1. The asset section of the company's balance sheet is provided below: Required:1) Compute Longwood Company's end-of-year working capital.2) Compute the company's quick (acid-test) ratio.3) The company has a debt agreement with its bank that authorizes the bank to call in its loan to the company if the company's current ratio falls below 3:1 as of the last day of any month during the term of the loan. During January Year 2, the company engaged in the three following transactions:(a) Collected $100,000 on account;(b) Purchased inventory on account, $50,000(c) Paid accounts payable, $60,000Will

Required:1) Compute Longwood Company's end-of-year working capital.2) Compute the company's quick (acid-test) ratio.3) The company has a debt agreement with its bank that authorizes the bank to call in its loan to the company if the company's current ratio falls below 3:1 as of the last day of any month during the term of the loan. During January Year 2, the company engaged in the three following transactions:(a) Collected $100,000 on account;(b) Purchased inventory on account, $50,000(c) Paid accounts payable, $60,000Will

the company be in default after completing these transactions? Justify your answer.Round your answers to two decimal places.

What will be an ideal response?

1) Current assets = $2,000,000 - $926,000 = $1,074,000; Current assets ÷ current liabilities = 3

Thus, current liabilities = $1,074,000 ÷ 3 = $358,000; Finally, working capital = current assets - current liabilities. Thus, $1,074,000 - $358,000 = $716,000

2) Acid-test = (current assets - inventory - prepaid expenses) ÷ current liabilities = ($1,074,000 - $550,000 - $74,000) ÷ $358,000 = $450,000 ÷ $358,000 = 1.26:1

3) Impact of transactions on current ratio:

(a) Collection on account has no impact on the current ratio.

(b) Purchase of inventory on account reduces the current ratio. Adding $50,000 to both the numerator and the denominator decreases the current ratio from 3:1 to 2.75:1.

(c) Payment on account increases the current ratio. Decreasing both the numerator and the denominator increases the current ratio from 2:75:1 to 3.06:1. Therefore, the company is not in default after these transactions.

You might also like to view...

Daisy tried to apply the job characteristics model to her workforce, but it only worked for some of her employees. Which of the following may be a reason why it did not work for everyone?

A. Some of her employees are lazy. B. Some of her employees are low in growth-need strength. C. Some of her employees have a low need for power. D. All of her employees have high growth-needs. E. Some of her employees have low affiliation needs.

Keen Beans, a leading coffee roaster, anticipated that the prices of coffee beans from Costa Rica, where its main suppliers were located, would double in less than three years. This would significantly affect Keen Beans' profit margins. Thus, Keen Beans decided to develop a new partnership with a supplier in Indonesia. As predicted, the price of Costa Rican coffee beans increased twofold. Because the price of Indonesian coffee beans was much lower, Keen Beans was able to maintain its profit margins in turbulent times. Which of the following isolating mechanisms does this scenario best illustrate?

A. causal ambiguity B. better expectations of future resource value C. time compression diseconomies D. intellectual property protection

Dumping is the sale of imported goods at "less than fair value."

Indicate whether the statement is true or false

In the context of factors of production,the synthetic resources that a business needs to produce goods or servicesare referred to as _____.

A. nonprofits B. the hard sell C. capital D. depositories