What is the Value Net framework? What are the steps in using this framework?

What will be an ideal response?

Like the five forces framework, the Value Net includes an analysis of buyers, suppliers, and substitutors (as shown in Figure 3.9), but it differs from the five forces framework in several important ways:

• First, the analysis focuses on the interactions of industry participants with a particular company. Thus it places that firm in the center of the framework.

• Second, the category of "competitors" is defined to include not only the focal firm's direct competitors or industry rivals but also the sellers of substitute products and potential entrants.

• Third, the Value Net framework introduces a new category of industry participant that is not found in the five forces framework-that of "complementors." The inclusion of complementors draws particular attention to the fact that success in the marketplace need not come at the expense of other industry participants. Interactions among industry participants may be cooperative in nature rather than competitive.

You might also like to view...

Which of the following is true about values?

A. Values are the highest standards of appropriate and proper behavior. B. Values cannot lead to unethical results. C. Corporate scandals prove the fact that individuals have personal values, but institutions lack values. D. Values are underlying beliefs that cause us to act or to decide in a certain way.

To establish an evoked set, consumers must

A. establish evaluative criteria. B. have brand loyalty. C. experience cognitive dissonance. D. recognize personal influences. E. avoid post-purchase evaluation.

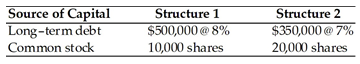

Frankline Coin, Inc. is considering two capital structures. The key information follows. Assume a 40 percent tax rate and expected EBIT of $50,000.

a) Calculate two EBIT-EPS coordinates for each of the structures.

(b) Indicate over what EBIT range, if any, each structure is preferred

In 2017, Zachary incurs no AMT adjustments, and his only AMT preference (which is also his only itemized deduction) is $42,000 of state and local and real property taxes

If Zachary were a single taxpayer who itemized deductions and had taxable income of $95,000, his regular tax liability would be $19,582 and his AMT liability would be $22,555. Assume instead that Zachary is a married taxpayer filing jointly in 2017 . The couple's taxable income amount is changed only by the additional personal exemption. In comparison to the tax liability amounts presented above, the couple's regular and AMT tax liabilities would be: a. Higher, Higher b. Higher, Lower c. Lower, Higher d. Lower, Lower