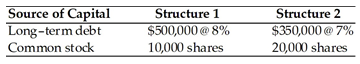

Frankline Coin, Inc. is considering two capital structures. The key information follows. Assume a 40 percent tax rate and expected EBIT of $50,000.

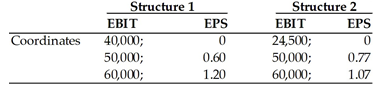

a) Calculate two EBIT-EPS coordinates for each of the structures.

(b) Indicate over what EBIT range, if any, each structure is preferred

(a)

(b) Calculation of indifference point

EPS (Structure 1) = EPS (Structure 2)

(EBIT - $40,000)(1 - 0.40)/10,000 = (EBIT - $24,500)(1 - 0.40)/20,000

If EBIT is expected to be less than $55,500, structure 2 will maximize EPS. If EBIT is expected to be greater than $55,500, Structure 1 will maximize EPS.

You might also like to view...

The Frank Company has issued 10%, fully participating, cumulative preferred stock with a total par value of $300,000 and common stock with a total par value of $900,000. Dividends for one previous year are in arrears. How much cash will be paid to the preferred stockholders and the common stockholders, respectively, if cash dividends of $222,000 are distributed at the end of the current year?

A) $85,500 to preferred and $136,500 to common B) $78,000 to preferred and $144,000 to common C) $60,000 to preferred and $162,000 to common D) $55,500 to preferred and $166,500 to common

What is a user-defined procedure?

A company plans to sell its products to a market segment consisting of "outgoing personalities." This will likely NOT be a good market segment, primarily because of which of the following criteria?

A. heterogeneous between B. operational C. homogeneous within D. generic E. substantial

Linda owns a bakery and wants to hire Bill, a Web-page developer, to create a new site for her company. Linda does not need Bill on staff permanently. Bill would be considered a(n) ________

A) contingent worker B) independent contractor C) permanent part-time worker D) flextime worker E) telecommuter