If a bank desires to hold no excess reserves, the reserve requirement is 8 percent, and it receives a new deposit of $500,

a. its required reserves increase by $40.

b. its total reserves initially increase by $460.

c. it will be able to make a new loan of up to $492.

d. All of the above are correct.

a

You might also like to view...

The amount of frictional unemployment depends on

A) the phase of the business cycle. B) the time of the year. C) international competition. D) demographic factors and unemployment benefits. E) Both answers A and B are correct.

A firm that decides to make a price cut assumes that marginal profit is negative.

Answer the following statement true (T) or false (F)

The U.S. government sets a minimum wage, which is a:

a. price floor. b. price ceiling. c. point of equilibrium. d. recommended level.

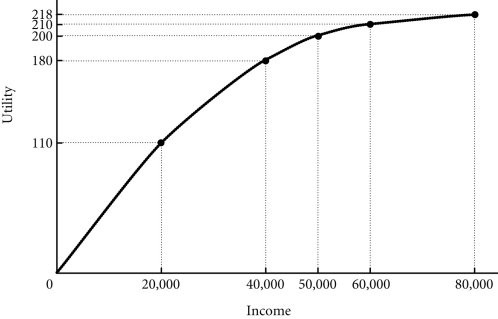

Refer to the information provided in Figure 17.1 below to answer the question(s) that follow.  Figure 17.1 Refer to Figure 17.1. John has two job offers when he graduates from college. John views the offers as identical, except for the salary terms. The first offer is at a fixed annual salary of $50,000. The second offer is at a fixed salary of $20,000 plus a possible bonus of $60,000. John believes that he has a 50-50 chance of earning the bonus. What is the expected value of John's income for each job offer?

Figure 17.1 Refer to Figure 17.1. John has two job offers when he graduates from college. John views the offers as identical, except for the salary terms. The first offer is at a fixed annual salary of $50,000. The second offer is at a fixed salary of $20,000 plus a possible bonus of $60,000. John believes that he has a 50-50 chance of earning the bonus. What is the expected value of John's income for each job offer?

A. $25,000 for the first offer and $50,000 for the second offer B. $50,000 for the first offer and $50,000 for the second offer C. $50,000 for the first offer and $80,000 for the second offer D. $50,000 for the first offer and $30,000 for the second offer