On December 31, 2016, interest of $1,500 has accrued on a bank note. This interest payment is due on January 20, 2017. If no adjusting entry is made on December 31, 2016, indicate the effect on assets, liabilities, equity, and net income

Understated, Overstated, No Effect

Assets

Liabilities

Equity

Net Income

What will be an ideal response

Understated, Overstated, No Effect

Assets No Effect

Liabilities Understated

Equity Overstated

Net Income Overstated

You might also like to view...

Describe the problems created by modern social media at work.

What will be an ideal response?

Identify a true statement about robots.

A. They cannot be used over rugged terrain. B. They can assist an operations manager in formulating the production plan. C. They can maintain a consistently high level of performance. D. They are task specific and cannot be reprogrammed to perform new tricks.

Which of the following is NOT a potential source of cash for a firm?

A) A decrease in Accounts receivable B) A decrease in inventory C) An increase in retained earnings D) A decrease in equity

Prime Corporation liquidates its 85%-owned subsidiary Bass Corporation under the provisions of Secs. 332 and 337. Bass Corporation distributes land to its minority shareholder, John, who owns a 15% interest. The property received by John has a $55,000 FMV. The land was used in the Bass Corporation's business and has a $65,000 adjusted basis and is subject to a $10,000 liability, which is assumed

by John. John's basis in his stock is $25,000. What gain or loss will John and Bass Corporation recognize on the distribution of the land?

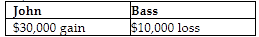

a.

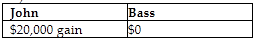

b.

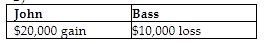

c.

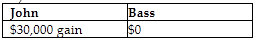

d.