During its inception, Devon Company purchased land for $100,000 and a building for $180,000. After exactly 3 years, it transferred these assets and cash of $50,000 to a newly created subsidiary, Regan Company, in exchange for 15,000 shares of Regan's $10 par value stock. Devon uses straight-line depreciation. Useful life for the building is 30 years, with zero residual value. An appraisal revealed that the building has a fair value of $200,000.Based on the information provided, at the time of the transfer, Regan Company should record:

A. Building at $162,000 and no accumulated depreciation.

B. Building at $180,000 and accumulated depreciation of $18,000.

C. Building at $180,000 and no accumulated depreciation.

D. Building at $200,000 and accumulated depreciation of $24,000.

Answer: B

You might also like to view...

The retail price of a sweater is $75, and the initial markup is 51 percent. Calculate the cost of the product.

A. $25.71 B. $42.85 C. $28.50 D. $36.75 E. $33.75

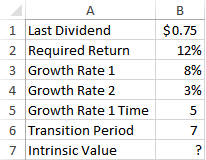

The last dividend payment of a stock was $0.75 and this dividend is expected to grow at 8% per year for three years. After that, the dividend will grow at 3% indefinitely. Assume that the transition between 8% and 3% will be gradual rather than instantaneous. The transition period is 3 years. Using the H-Model, what is the correct formula for B7 if the required rate of return on this stock is 12%?

a) =B1/(B2-B4*(1+B4+B5+B5+B6)/2*(B3-B4))

b) =(B1/(B2-B4)*(1+B4+(B5+B6)/2*(B3-B4)))

c) =(B1/(B2+B4)*(1-B4-(B5-B5-B6)/2*(B3+B4)))

d) =(B1/(B2-B3)*(1+B2+(B5+B5+B6)/2*(B4-B3)))

e) =(B1/(B2-B4)*(1+B4+(B5+B5+B6)/2*(B3-B4)))

Tamara is admired and respected and is seen as a change agent. She is demonstrating which of the following of the behaviors of transformational leaders?

A. individualized consideration B. inspirational motivation C. intellectual stimulation D. idealized influence

Capital budgeting involves evaluating and ranking alternative future investments in order to effectively allocate limited capital

Indicate whether the statement is true or false