If the demand for online banking decreases, we would expect to see the

A) supply of workers that produce online-banking services to increase.

B) supply of workers that produce online-banking services to decrease.

C) demand for workers that produce online-banking services to increase.

D) demand for workers that produce online-banking services to decrease.

Answer: D

You might also like to view...

Automobile companies typically make some of the parts for cars (for example, the body and engine) but not others (for example, the tires). Under what conditions would you expect an automobile manufacturer to be most likely to buy inputs from other companies?

a. when the specifications (size, style, etc.) of the inputs change frequently b. when the inputs being produced have little value c. when market prices have not been established for the inputs d. when it is relatively easy to measure the quantity and quality of the input

Suppose that when the price of a good falls from $12 to $9, the quantity demanded of that good rises from 310 units to 350 units. What is the approximate price elasticity of demand between these two prices?

a. 0.42 b. 2.36 c. 0.68 d. 3.80 e. 1.12

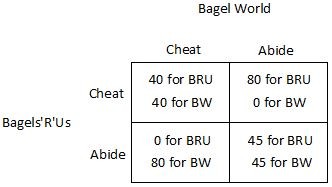

The market for bagels contains two firms: BagelWorld (BW) and Bagels'R'Us (BRU). The owners of the two firms decide to fix the price of bagels. The table below shows how each firm's profit (in dollars) depends on whether they abide by the agreement or cheat on the agreement.  Suppose the game above is repeated every day, and both firms adopt the following strategy: cooperate on the first day, then if the other firm cheats, cheat the next day, and if the other firm abides, abide the next day. This type of strategy is known as:

Suppose the game above is repeated every day, and both firms adopt the following strategy: cooperate on the first day, then if the other firm cheats, cheat the next day, and if the other firm abides, abide the next day. This type of strategy is known as:

A. a prisoner's dilemma. B. the golden rule. C. the cartel solution. D. a tit-for-tat strategy.

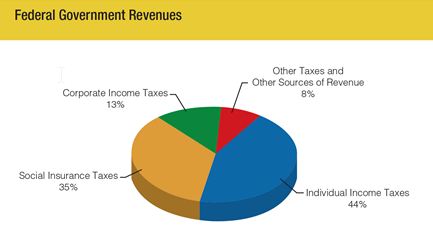

Based on the pie chart showing federal government revenue, the two sources that combine to provide roughly 80% of federal revenue are ______.

a. individual income tax and corporate income tax

b. corporate income tax and social insurance tax

c. social insurance tax and individual income tax

d. miscellaneous other tax and social insurance tax