Refer to Table 8-5. The value added by the automobile dealer equals

A) $7,000. B) $15,000. C) $18,000. D) $25,000.

A

You might also like to view...

In the long run, a perfectly competitive firm will

A) be able to make an economic profit. B) produce but incur an economic loss. C) make zero economic profit. D) not produce and will incur an economic loss equal to its total fixed cost. E) not produce but not incur an economic loss.

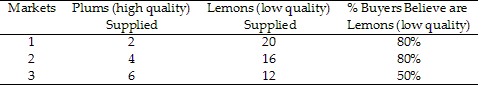

In Table 9.4, Market 3 would be in equilibrium if buyers believed plums accounted for:

In Table 9.4, Market 3 would be in equilibrium if buyers believed plums accounted for:

A. 11.11% of the market. B. 22.22% of the market. C. 33.33% of the market. D. 66.67% of the market.

Which of the following statements is FALSE, with respect to what economist Adam Smith called the diamond-water paradox?

A. There are relatively few diamonds, so the marginal utility of the last diamond consumed is relatively high. B. Total utility does not determine what people are willing to pay for a unit of a particular commodity; marginal utility does. C. The total utility of water greatly exceeds the total utility derived from diamonds. D. The demand for water is much smaller than the demand for diamonds.

We can draw demand curves for firms in perfectly competitive and monopolistically competitive industries, but not for oligopoly firms. The reason for this is

A) there are no barriers to entry in perfectly competitive and monopolistically competitive industries. There are high barriers to entry in oligopoly industries. B) we can assume that the prices charged by perfectly competitive and monopolistically competitive firms have no impact on rival firms. For oligopoly this assumption is unrealistic. C) that perfectly competitive and monopolistically competitive firms are price takers. Oligopoly firms are price makers. D) perfectly competitive and monopolistically competitive firms sell standardized products. Oligopoly firms sell differentiated products.