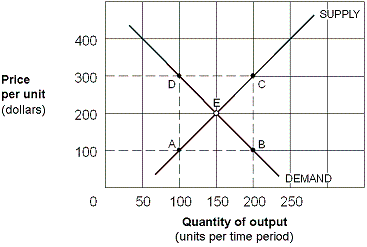

Exhibit 5-9 Supply and Demand Curves for Good X

?

In Exhibit 5-9, assume the government places a $200 per unit sales tax on Good X. The percentage of the burden of taxation paid by consumers of Good X is:

A. zero.

B. 25 percent.

C. 50 percent.

D. 100 percent.

Answer: C

You might also like to view...

Historically, the government has used fiscal policy to affect the economy through

a. central planning. b. indicative planning. c. aggregate demand. d. aggregate supply.

Assume the government reduces government spending. What is the first round effect on the components of the balance of payments (assume low international capital mobility and fixed exchange rates; also assume that before the government action all the components were 0)? a. Current international transactions balance and reserves account become positive; net nonreserve international

borrowing/lending balance becomes negative. b. Current international transactions balance becomes positive; net nonreserve international borrowing/lending balance and reserves account become negative. c. Net nonreserve international borrowing/lending balance becomes positive; current international transactions balance and reserves account becomes negative. d. Net nonreserve international borrowing/lending balance and reserves account become positive; current international transactions balance becomes negative. e. Reserves account becomes positive; current international transactions balance and net nonreserve international borrowing/lending balance become negative.

If the producers' surplus is $50, and the consumers' surplus is $40, then what is the minimum selling price of the good?

A) $10 B) $40 C) $50 D) $90 E) There is not enough information to answer the question.

The government of Blenova considers two policies. Policy A would shift AD right by 500 units while policy B would shift AD right by 300 units. According to the short-run Phillips curve, policy A will lead

a. to a lower unemployment rate and a lower inflation rate than policy B. b. to a lower unemployment rate and a higher inflation rate than policy B. c. to a higher unemployment rate and lower inflation rate than policy B. d. to a higher unemployment rate and higher inflation rate than policy B.