Use the percentage method of withholding to find the federal withholding tax, a 6.2% FICA rate to find the FICA tax, and 1.45% to find the Medicare tax. Then find the net pay for the employee. Assume that the employee has not earned over $115,000 so far this year.

Carla LaFong has gross earnings of $3576.57 weekly. She is married and has 2 withholding allowances.

Carla LaFong has gross earnings of $3576.57 weekly. She is married and has 2 withholding allowances.

A. $3,302.96

B. $2,894.66

C. $2,621.05

D. $3,984.87

Answer: C

You might also like to view...

Perform the indicated operation. Write the answer in simplest form. If the answer is an improper fraction, write it as a mixed number.30 ÷ 1

A. 16

B. 17

C. 19

D. 18

Solve the problem.A projectile is fired with an initial velocity of 500 feet per second at an angle of 45° with the horizontal. To the nearest foot, find the maximum altitude of the projectile. The parametric equations for the path of the projectile are x = (500 cos 45°)t, and y = (500 sin 45°)t - 16t2.

A. 1,945 feet B. 1,953 feet C. 1,969 feet D. 1,936 feet

Graph the function by starting with the graph of the basic function and then using the techniques of shifting, compressing, stretching, and/or reflecting.f(x) =  |x|

|x|

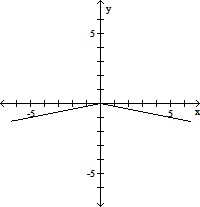

A.

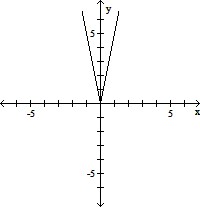

B.

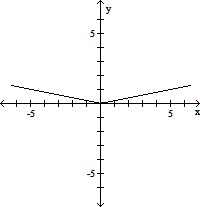

C.

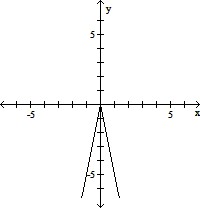

D.

Solve the problem.Determine whether the ordered triple (2, 8, -3) is a solution of the system of equations.3x - 4y - 2z = -204x + y - z = 19 x - 2y + 3z = -23

A. Yes B. No