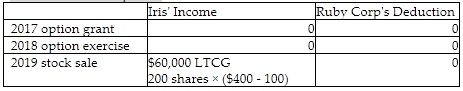

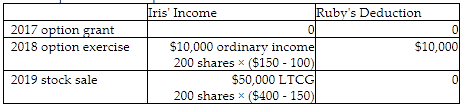

Ruby Corporation grants stock options to Iris on February 1, 2017. The options do not have a readily ascertainable value. The option price is $100, and the FMV of the Ruby stock is also $100 on the grant date. The option allows Iris to purchase 200 shares of Ruby stock. Iris exercises the option on August 1, 2018, when the stock's FMV is $150. Iris sells the stock on December 5, 2019 for $400.

Determine the amount and character (i.e., ordinary, LTCG or STCG) of income recognized by Iris and the deduction allowed Ruby Corporation in 2017, 2018 and 2019 under the following assumptions:

a. The stock option is an incentive stock option.

b. The stock option is a nonqualified stock option.

a. Incentive stock option

b. Non-qualified stock option

You might also like to view...

Frederick Company borrows $63,000 from First City Bank and pledges its receivables as security. Which of the following is true regarding this transaction:

A. Frederick Company no longer has the risk of bad debts. B. Frederick Company's financial statements must disclose the pledging of receivables. C. First City Bank is the factor in this transaction. D. First City Bank takes ownership of the receivables at the time of the pledge. E. No journal entry is required for this event.

Sandra is a manager at Starlight Inc She wants to upgrade the quality of Starlight's products. She calls for a meeting with the technical experts of the company and asks for suggestions on how to achieve this goal. She gathers information by listening to each of the experts. In this scenario, Sandra is engaged in _____.?

A) ?casual listening B) ?grapevine communication C) ?intensive listening D) ?kinesic communication

The following information relates to Leonard Manufacturing's overhead costs for the month

Static budget variable overhead $14,200 Static budget fixed overhead $5,600 Static budget direct labor hours 1,000 hours Static budget number of units 5,000 units Leonard allocates manufacturing overhead to production based on standard direct labor hours. Leonard reported the following actual results for last month: actual variable overhead, $14,500; actual fixed overhead, $5,400; actual production of 4,700 units at 0.22 direct labor hours per unit. The standard direct labor time is 0.20 direct labor hours per unit. Compute the fixed overhead cost variance. What will be an ideal response

What are the key questions managers must answer to formulate an appropriate business-level strategy?

What will be an ideal response?