Suppose the U.S. dollar price of the Euro falls. This means that

A) the U.S. exchange rate has risen and the U.S. dollar buys more euros.

B) the U.S. exchange rate has risen and the U.S. dollar buys less euros C) the U.S. exchange rate has fallen and the U.S. dollar buys more euros.

D) the U.S. exchange rate has fallen and the U.S. dollar buys less euros.

Ans: A) the U.S. exchange rate has risen and the U.S. dollar buys more euros.

You might also like to view...

Refer to Table 1-6. What is Ivan's marginal cost if he decides to stay open for six hours instead of five hours?

A) $10 B) $20 C) $25 D) $91.67

If private investment had held up as well as consumption did, the economic contraction from 1929 to 1933 would have been less severe than it was

Indicate whether the statement is true or false

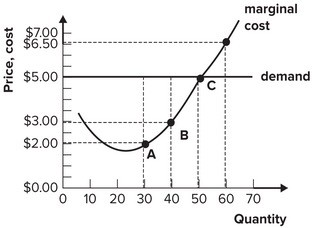

Refer to the graph shown. If the firm increases output from 30 to 40, total revenue will increase:

A. more than total cost, and so profit will decrease. B. less than total cost, and so profit will decrease. C. more than total cost, and so profit will increase. D. less than total cost, and so profit will increase.

Fiscal policy can act just like monetary policy to offset shifts in the dynamic aggregate demand curve and stabilize inflation and output. Explain how the two policies could have the same effect.

What will be an ideal response?