Holding many risky assets and thus reducing the overall risk an investor faces is called

A) diversification.

B) foolishness.

C) risk acceptance.

D) capitalization.

A

You might also like to view...

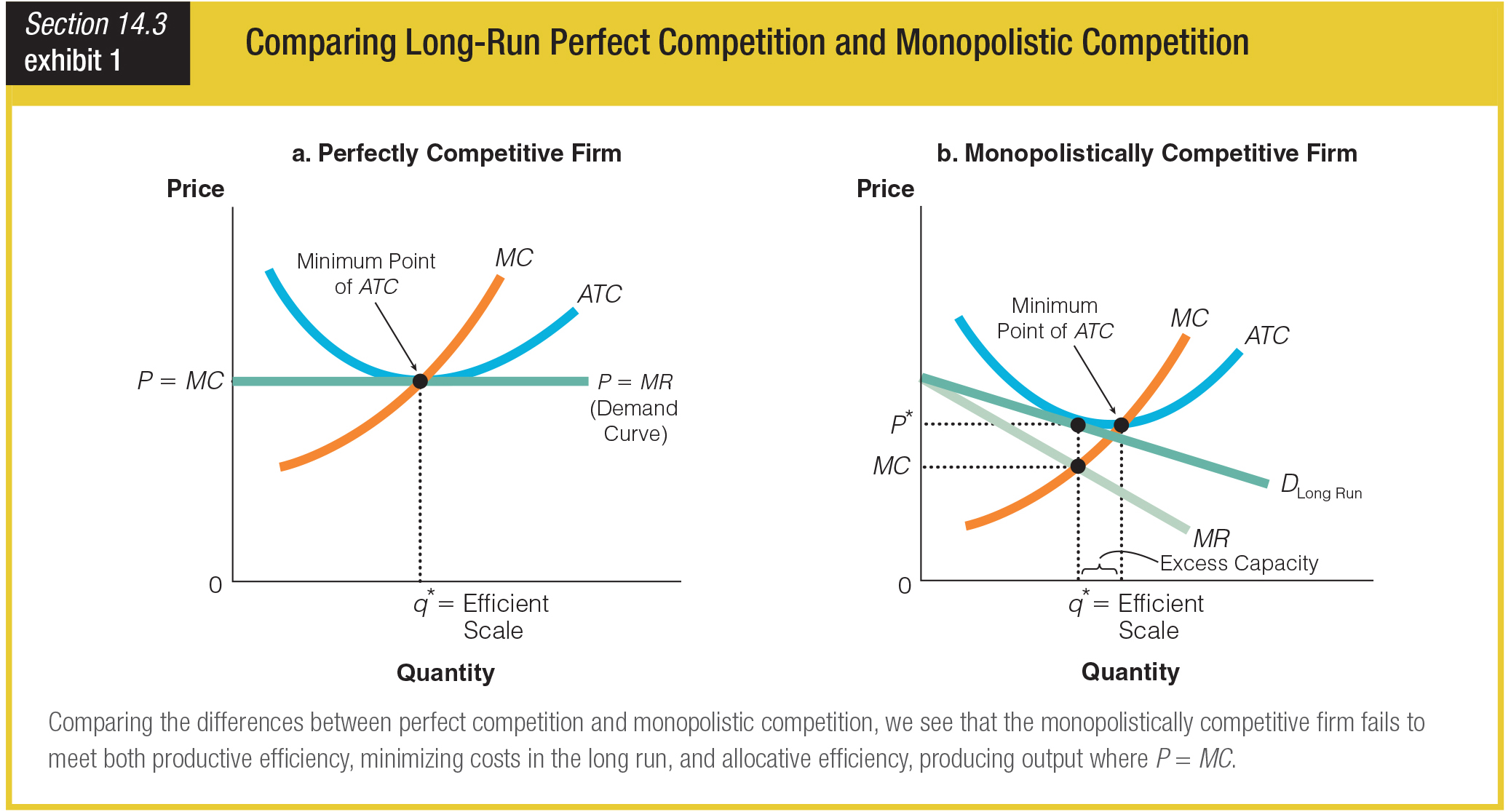

Graph a and graph b have several differences. What difference between the two shows a failure to meet productive efficiency?

a. In graph a, ATC touches the demand curve at P equals MC.

b. In graph b, the demand curve is downward sloping.

c. In graph a, P equals both MR and MC.

d. In graph b, MC is less than P*, and q* is less than it could be.

When was the first Bank of the United States formed by the Federalists?

(A) In the first quarter of the nineteenth century (B) During the American Revolution (C) In the late eighteenth century (D) After the Civil War

Which of the following best describes a Nash equilibrium?

A. An outcome from which one or both competitors can improve their position by adopting an alternative strategy. B. The unstable outcome of a repeated game. C. An outcome that is stable only because of credible threats. D. An outcome that both competitors see as optimal, given the strategy of their rival.

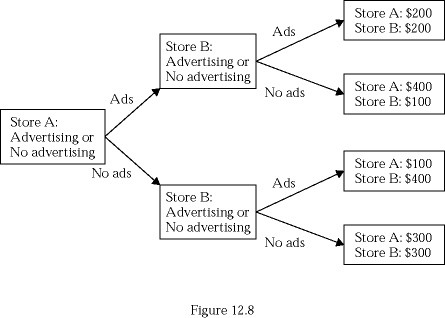

Figure 12.8 depicts an advertising game between two stores. Which of the following statements is correct?

Figure 12.8 depicts an advertising game between two stores. Which of the following statements is correct?

A. Both stores have a dominant strategy. B. Neither store has a dominant strategy. C. Only Store A has a dominant strategy. D. Only Store B has a dominant strategy.