If a firm produces nothing, then its:

A. variable costs equal zero.

B. fixed costs equal zero.

C. total costs equal zero.

D. All of these are true.

A. variable costs equal zero.

You might also like to view...

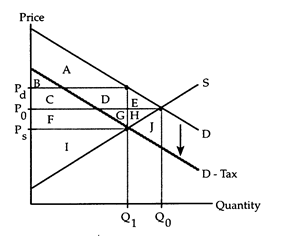

Refer to Sales Tax. Area C + D + F + G

The following questions refer to the accompanying diagram which shows the effects of a sales tax imposed on consumers. The initial price and quantity are P0 and Q0, respectively. After the tax is imposed, the equilibrium quantity is Q1, firms receive the price Ps, and consumers pay the price Pd.

a. the total value that consumers receive from their purchases.

b. the tax revenue collected by the government.

c. the fall in producers' surplus.

d. the deadweight loss due to the tax.

According to this Application, over time, as economies adapt to higher temperatures

A) approximately half the decline in per capita income disappears. B) per capita income does not seem to change. C) real income begins to increase and per capita income begins to decrease. D) approximately half the increase in per capita income disappears.

The Athenian Theatre sells tickets for the same play at different prices: a lower price to those who opt for the seats at the back of the theatre and a higher price for those who purchase seats in the front, around the stage

Which of the following statements is true? A) This is an example of product differentiation but not price discrimination. B) Since the cost of producing the play does not change with the seating configuration, this is evidence of price discrimination based on market segmentation. C) Charging two different prices is an effective way to avoid an excess demand for play tickets; the higher price lowers quantity demanded to some extent. D) The theatre practices first-degree price discrimination by setting prices based on willingness to pay.

We can estimate that if a country grows at 7 percent per year, it will double its real GDP per capita in:

A. 2 years. B. 20 years. C. 35 years. D. 10 years.