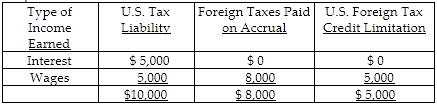

Karen, a U.S. citizen, earns $40,000 of taxable income from U.S. sources, $20,000 in taxable wages from Country A and $20,000 in taxable interest from Country B. The U.S. tax rate is 25%. The tax on Country A income is $8,000, and Country B charges no tax on the interest income. Assuming two baskets are needed for the two types of income because the interest is passive income, Karen's foreign tax

credit that can be claimed is

A) $5,000.

B) $10,000.

C) $20,000.

D) none of the above

A) $5,000.

You might also like to view...

According to the text, the extent to which an IC relies on subsidiary management to make decisions depends on all of the following except:

A. whether the subsidiary managers have degrees in business. B. IC management understanding host country conditions. C. how well the executives know one another. D. the distance between the home country and the host country.

Products should be processed further if the additional revenue exceeds the ________

a. contribution margin b. additional cost of processing c. total cost of production d. total profit earned

How are trade unions likely to influence MNEs?

a) Direct conflict b) Creating barriers to global integration c) Low union membership d) They have no influence

Debt securities represent an ownership interest in the corporation

a. True b. False Indicate whether the statement is true or false