Moore, an employee of Lewpenski Motors, fraudulently tells Tolson, a prospective car buyer, that the used car he is considering has never been in an accident. If Tolson buys the car in reliance on Moore's false statement, both Moore and Lewpenski Motors are liable to Tolson for damages based on the fraudulent misrepresentation

a. True

b. False

Indicate whether the statement is true or false

True

You might also like to view...

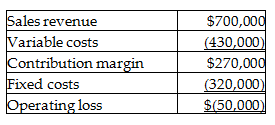

Castillo has just encountered environmental problems with the product and will be forced to drop the product line altogether. Castillo will be able to eliminate 60% of the fixed costs. What will be the impact on operating income of the company?

Castillo Corporation has provided you with the following budgeted income statement for one of its products:

A) Operating income will decrease by $192,000.

B) Operating income will decrease by $78,000.

C) Operating income will increase by $192,000.

D) Operating income will increase by $78,000.

In the United States and many other countries, bribes are

A. unethical. B. ethical only under certain circumstances. C. uncommon in many foreign countries. D. economic returns. E. ethical.

Which of the following would be a correctly reported statistical test?

a. q = 16, p = .02 b. h > 43, p = .17 c. F = 19, p ? .87 d. None of the above

Miley, a single taxpayer, plans on reporting $30,475 of taxable income this year (all of her income is from a part-time job). She is considering applying for a second part-time job that would give her an additional $10,000 of taxable income. By how much will the income from the second job increase her tax liability? (Use the Tax rate schedules.)

A. $2,400 B. $1,200 C. $1,000 D. $1,300