A bank currently has $50 million in deposits, $6 million in cash in the vault, $4 million on deposit with the Fed, and $5 million in government securities. The reserve ratio is 20 percent. A new deposit is made of $1 million

What is the maximum size loan the bank can make once the check clears?

A) $1 million B) $5.8 million C) $800,000 D) 0

C

You might also like to view...

________ is the amount of money a government collects through a tax

A) Tax incidence B) Tax bracket C) Tax revenue D) Tax burden

In 2008, the many people became unable to make payments on their mortgages and instead defaulted on them. As a result, the ________ of loanable funds curve shifts ________ and real interest rate ________

A) supply; leftward; increases B) demand; leftward; increases. C) supply; rightward; falls. D) demand; rightward; decreases.

Politicians often argue for tariff increases in order to reduce the size of a balance of trade deficit. If tariffs are increased, the long-run effect is most likely to be: a. a decrease in both U.S. imports and exports

b. an increase in both U.S. imports and exports. c. an decrease in U.S. imports, and an increase in U.S. exports. d. an increase in U.S. imports, and a decrease in U.S. exports.

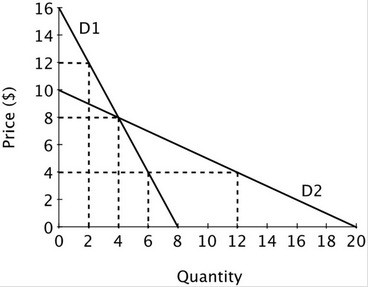

Refer to the accompanying figure. When P = 4, the price elasticity of demand for the demand curve D1 is ________ and D2 is ________.

A. 1/3; 3 B. 3; 3 C. 1/3; 2/3 D. 2/3; 1/3