________ is the amount of money a government collects through a tax

A) Tax incidence

B) Tax bracket

C) Tax revenue

D) Tax burden

C

You might also like to view...

The De Beers Company blocked competition

A) by controlling the supply of most of the world's high-quality bauxite, the mineral used to produce aluminum. B) in the diamond market by controlling the output of most of the world's diamond mines. C) in the market for fresh and frozen cranberries because it controls about 80 percent of the cranberry crop. D) because it has lower production costs than other department stores due to economies of scale.

If the actual price level is less than the expected price level reflected in long-term contracts, _____

a. firms will find production more profitable in the short run than they had expected and will decrease the quantity of output supplied b. firms will find production less profitable in the short run than they had expected and will decrease the quantity of output supplied c. firms will find production more profitable in the short run than they had expected and will increase the quantity of output supplied d. resource owners will earn higher returns in the short run than they had expected and will decrease the quantity of resources supplied e. unemployment will increase in the short run as firms will substitute labor with capital inputs

Open-market operations refer to:

A. purchases of stocks in the New York Stock Exchange. B. the purchase or sale of government securities by the Fed. C. central bank lending to commercial banks. D. the specifying of loan maximums on stock purchases.

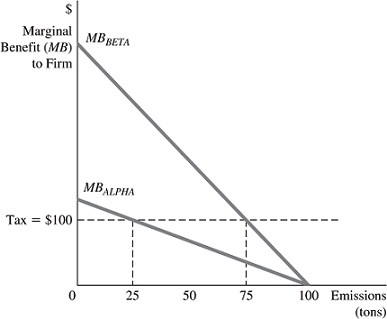

Refer to the information in Figure 16.5 below to answer the question(s) that follow. ?Figure 16.5Figure 16.5 shows the marginal benefits of emitting pollution for the only two chemical companies in an industry, Alpha Chemicals and Beta Chemicals. Before any tax on pollution emissions is imposed, each company views pollution as being free.Refer to Figure 16.5. The government decides to impose a tax on pollution emissions to cut total emissions in this industry in half, and based on this decision it has set the tax at $100 per ton of emissions. Following the implementation of this tax, the total amount of tax revenue collected by the government from this

?Figure 16.5Figure 16.5 shows the marginal benefits of emitting pollution for the only two chemical companies in an industry, Alpha Chemicals and Beta Chemicals. Before any tax on pollution emissions is imposed, each company views pollution as being free.Refer to Figure 16.5. The government decides to impose a tax on pollution emissions to cut total emissions in this industry in half, and based on this decision it has set the tax at $100 per ton of emissions. Following the implementation of this tax, the total amount of tax revenue collected by the government from this

tax will be A. $5,000. B. $7,500. C. $10,000. D. $20,000.