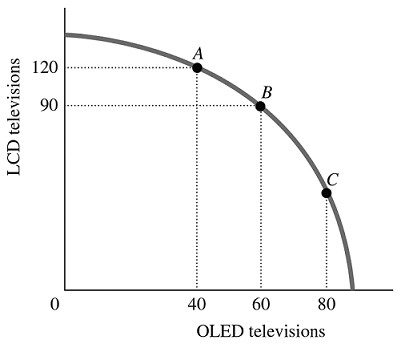

Refer to the information provided in Figure 2.5 below to answer the question(s) that follow. Figure 2.5Refer to Figure 2.5. The economy is currently at Point B. The opportunity cost of moving from Point B to Point A is the

Figure 2.5Refer to Figure 2.5. The economy is currently at Point B. The opportunity cost of moving from Point B to Point A is the

A. 120 LCD TVs that must be forgone to produce 20 additional OLED TVs.

B. 30 LCD TVs that must be forgone to produce 40 additional OLED TVs.

C. 20 OLED TVs that must be forgone to produce 30 additional LCD TVs.

D. 40 OLED TVs that must be forgone to produce 120 additional LCD TVs.

Answer: C

You might also like to view...

When import restrictions are placed on a good, and as a result the price of the good increases, the demand curve for that good will

A) shift rightward. B) shift leftward. C) become steeper. D) be unaffected.

If government spending were to increase we expect that the aggregate demand curve will:

A. shift straight down. B. shift to the right. C. remain unchanged but the economy will move down along the curve to a higher quantity. D. remain unchanged but the economy will move down along the curve to a lower quantity.

A negative income tax system would

a. make taxes more regressive. b. sever the link between tax policy and income distribution. c. collect from high-income households and give transfers to low-income households. d. eliminate progressive tax rates.

For an imaginary economy, when the real interest rate is 5 percent, the quantity of loanable funds demanded is $100,000 and the quantity of loanable funds supplied is $100,000 . Currently, the nominal interest rate is 6 percent and the inflation rate is 2 percent. Currently,

a. the market for loanable funds is in equilibrium. b. the quantity of loanable funds supplied exceeds the quantity of loanable funds demanded, and as a result the real interest rate will rise. c. the quantity of loanable funds supplied exceeds the quantity of loanable funds demanded, and as a result the real interest rate will fall. d. the quantity of loanable funds demanded exceeds the quantity of loanable funds supplied, and as a result the real interest rate will rise.