Define vertical equity and horizontal equity. How do tax loopholes sometimes create vertical and horizontal inequity?

What will be an ideal response?

Vertical equity is the principle that people with higher incomes should pay more taxes. Horizontal equity is the principle that people with equal incomes should pay equal taxes. Tax loopholes permit one to subtract certain exemptions and deductions from gross income in computing taxable income. Therefore, people with the same gross incomes may end up with different taxable incomes, creating horizontal inequity. Also, a person with higher gross income might end up with lower taxable income than another individual, creating vertical inequity.

You might also like to view...

An oligopoly is a market structure in which a few large firms dominate the sale of a single product

a. True b. False Indicate whether the statement is true or false

Which of the following is true?

a. in recent decades, the rich countries of the world have consistently grown more rapidly than poor countries. b. no LDC was able to achieve a more rapid growth rate than the United States during the 1980 through 2005 period. c. during recent decades, most LDCs have stagnated economically. d. during 1980 through 2005, the fastest growing countries in the world were mostly LDCs.

Which is not considered a need?

a. food b. clothing c. shelter d. smartphone

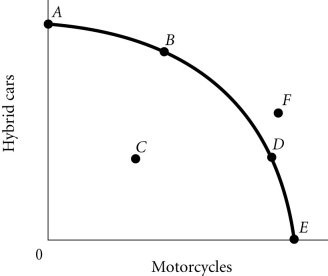

Refer to the information provided in Figure 2.4 below to answer the question(s) that follow. Figure 2.4Refer to Figure 2.4. The economy moves from Point A to Point D. This could be explained by

Figure 2.4Refer to Figure 2.4. The economy moves from Point A to Point D. This could be explained by

A. an increase in economic growth. B. a change in society's preferences for motorcycles versus hybrid cars. C. a reduction in unemployment. D. an improvement in technology.