Use the information in Scenario E.1. Approximately how many total customers arrived during the 2-hour period simulated?

A) 42

B) 38

C) 44

D) 48

D

You might also like to view...

Which type of team coaching is focused on building knowledge, skills, and abilities of group members?

a. Motivational b. Consultative c. Educational d. Contingent

What would be the amount appearing on the December 31, 2018 Consolidated Statement of Financial Position for deferred income taxes?

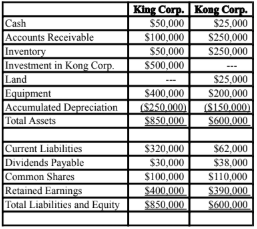

King Corp. owns 80% of Kong Corp. and uses the cost method to account for its investment, which it acquired on January 1, 2018. The Financial Statements of King Corp. and Kong Corp. for the Year ended December 31, 2018 are shown below:

Income Statements

Retained Earnings Statements

Balance Sheets

Other Information:

> King sold a tract of Land to Kong at a profit of $10,000 during 2018. This land is still the property of Kong Corp.

> On January 1, 2018, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

> On January 1, 2018, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2018, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

> Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

> Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

• Inventory had a fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2018.

• A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

• There was a goodwill impairment loss of $4,000 during 2018.

• Both companies are subject to an effective tax rate of 40%.

• Both companies use straight line amortization.

A) $11,200. B) $10,000. C) Nil. D) $12,000.

Merone Corporation applies manufacturing overhead to products on the basis of standard machine-hours. The company bases its predetermined overhead rate on 3700 machine-hours. The company's total budgeted fixed manufacturing overhead is $13,320. In the most recent month, the total actual fixed manufacturing overhead was $12,890. The company actually worked 3600 machine-hours during the month. The standard hours allowed for the actual output of the month totaled 3720 machine-hours. What was the overall fixed manufacturing overhead volume variance for the month?

A. $430 Favorable B. $72 Favorable C. $360 Unfavorable D. $360 Favorable

____________________ is Non-physical assets such as stocks, bonds, mortgages, lease agreements.

Fill in the blank(s) with the appropriate word(s).