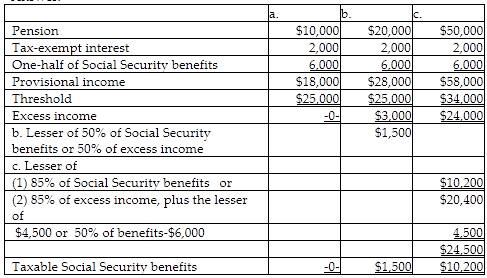

Betty is a single retiree who receives Social Security benefits of $12,000, tax-exempt interest of $4,000 and a taxable pension. Determine the amount of taxable Social Security benefits assuming her annual pension is

a. $10,000.

b. $20,000.

c. $50,000.

You might also like to view...

Amos always felt that it was unfair that society created artificial divisions that discouraged him from having friends from different social structures. Which of the following terms describes the process that Amos is having difficulty with?

A) Reference group affiliation B) Bias C) Social anxiety D) Social stratification

Under management contracting, a domestic firm ________

A) adopts management know-how from a foreign company B) manufactures the products of a foreign company C) exports its products to a foreign company D) provides financial capital to a foreign company E) exports management services to a foreign company

Joseph’s work involves union votes, negotiations for union agreements, contract collective bargaining, and handling grievances. Joseph’s human resource management specialty is __________.

A. the legal environment B. compensation and benefits C. labor and industrial relations D. safety and security E. EEO

Recruiting and selection of salespeople should include enough steps to yield the information needed to make accurate selection decisions. However, the stages of the process should be sequenced so that the more expensive steps are

A. near the beginning. B. always completed before anything else. C. near the end. D. paid by the prospects rather than the company. E. never reached.