Which of the following does NOT describe why Britain adopted the pegged system (the Exchange Rate Mechanism [ERM]) in 1990?

A) There were benefits to trade and other forms of cross-border exchange.

B) Britain wanted to hold onto the pound as its currency.

C) It was a member of the European Union and fixed rates were good for trade with other members.

D) It hoped to participate in the new common currency when it was launched.

Ans: D) It hoped to participate in the new common currency when it was launched.

You might also like to view...

When a firm is operating at its minimum efficient scale, its

a. short-run average total cost of production is minimized b. long-run marginal cost of production is minimized c. long-run average cost of production is minimized d. long-run profit is maximized e. profit is at a maximum

Ronald Coase argued that firms exist due to the presence of

A) transfer costs. B) unions. C) transactions costs. D) easy market transactions.

Where marginal cost is less than average cost,

a. opportunity cost must have been excluded from the calculation of marginal cost. b. marginal cost must be falling. c. marginal cost must be rising. d. marginal cost may be rising, falling, or constant.

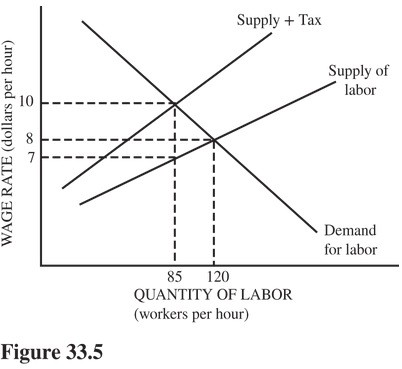

Refer to the labor market in Figure 33.5. Suppose that the government imposes a payroll tax on employers in this market. How much of the tax burden will the employers actually pay?

Refer to the labor market in Figure 33.5. Suppose that the government imposes a payroll tax on employers in this market. How much of the tax burden will the employers actually pay?

A. $8 - $7 = $1 per hour. B. $10 - $7 = $3 per hour. C. $10 - $8 = $2 per hour. D. None. The employers will pass the entire burden onto the workers.