Suppose a Canadian investor buys a one-year U.S. government bond that pays 7 percent interest. If the U.S. dollar appreciates 4 percent against the Canadian dollar during the year, what must be the yield on a comparable Canadian government bond for interest rate parity to hold?

a. 3 percent

b. 4 percent

c. 7 percent

d. 10 percent

e. 11 percent

e

You might also like to view...

Discuss the different effects on the domestic interest rates when prices are assumed flexible and when they are assumed to be sticky

What will be an ideal response?

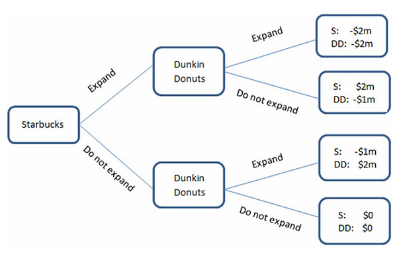

According to the figure shown, if Dunkin Donuts expands, then Starbucks should:

This figure displays the choices being made by two coffee shops: Starbucks and Dunkin Donuts. Both companies are trying to decide whether or not to expand in an area. The area can handle only one of them expanding, and whoever expands will cause the other to lose some business. If they both expand, the market will be saturated, and neither company will do well. The payoffs are the additional profits (or losses) they will earn.

A. also expand their business.

B. not expand.

C. give an ultimatum.

D. None of these statements is true.

If the quantity you buy of a good increases when your income increases, the good is clearly a(n)

a. essential good b. inferior good c. substitute good d. complementary good e. normal good

Under monopolistic competition, profits cannot persist because new firms will be attracted to the market.

Answer the following statement true (T) or false (F)