Suppose Congress raises taxes and the monetary authorities slow the annual money supply growth from 10 percent to 5 percent. If decision makers accurately anticipate the impact of these policy changes on prices,

a. unemployment will rise.

b. unemployment will fall.

c. there will be no effect on unemployment.

d. unemployment will fall if the change in monetary policy dominates, but unemployment will rise if the change in fiscal policy dominates.

C

You might also like to view...

Would the Keynesian consumption function work well in a world of libertarian paternalists?

What will be an ideal response?

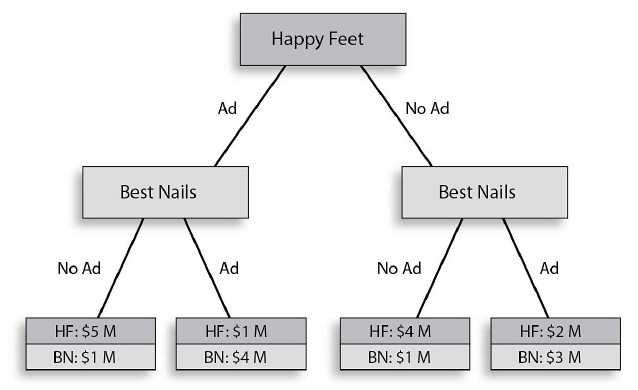

If Happy Feet chooses to No Ad and Best Nails then chooses to No Ad, Happy Feet earns ________ million in net profit and Best Nails earns ________ million.

Happy Feet wants to prevent Best Nails from entering the nail salon market. The above game tree illustrates the different strategies and corresponding payoffs for the two firms. Both Happy Feet and Best Nails have the same strategies of advertising (Ad) or not advertising (No Ad). The payoffs represent net profit in millions.

A) $1; $4 B) $2; $3 C) $4; $1 D) $5; $1

According to the above table, the marginal factor cost of the eighth worker is

A) $27.00. B) $48.00. C) $168.00. D) $216.00.

Oligopoly is a market structure in which

a. there are only two sellers. b. there are relatively few producers. c. no firm can influence price. d. there are many producers.