Supply-side economics stress that:

a. aggregate demand is the major determinant of real output

b. higher tax rates discourage people from working and investing as much as they would at lower tax rates.

c. an increase in government expenditures and tax rates will cause real income to rise.

d. expansionary monetary policy will cause real output to expand without accelerating inflation.

b

You might also like to view...

A government proposal to increase marginal tax rates on the wealthiest 2 percent of U.S. residents is supposed to generate an additional $100 billion in tax revenues. It is likely that

A) the actual revenue raised will exceed the $100 billion, because the other 98 percent of the population will increase their work effort with a more fair tax system. B) the actual revenue raised will be more than $100 billion, because the short-run aggregate supply curve is upward sloping. C) the actual revenue raised will be close to $100 billion, because the wealthy don't respond to work incentives the way poorer workers do. D) the actual revenue raised will be less than $100 billion, because some of the people will respond by working less and earning less income that can be taxed.

In 2013, ____ percent of college degrees were earned by women

a. 27 b. 37 c. 47 d. 57

A linear demand curve has a:

A. constant slope and a constant elasticity, but they need not be equal. B. changing slope, but constant elasticity. C. constant slope, but changing elasticity. D. slope which is the same as the elasticity.

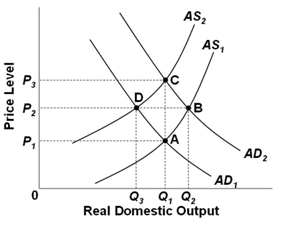

Refer to the graph below. Assume that the economy is initially at full-employment equilibrium at point A. If there is cost-push inflation in this economy and the government pursues an expansionary fiscal policy, then in the long run the:

A. Price level will rise from P1 to P2 and real output will be Q2

B. Price level will rise from P1 to P3 and real output will be Q1

C. Price level will rise from P1 to P2 and real output will be Q3

D. Price level will be P1 and real output will be Q1