Assume that in 2002 the nominal GDP was $350 billion and in 2003 it was $375 billion. On the basis of this information, we:

A. cannot make a meaningful comparison of the economy's performance in 2002 relative to 2003.

B. can conclude that the economy was achieving real economic growth.

C. can conclude that real GDP was higher in 2002 than in 2003.

D. can conclude that real GDP was lower in 2002 than in 2003.

A. cannot make a meaningful comparison of the economy's performance in 2002 relative to 2003.

You might also like to view...

Which of the following groups analyzes federal budgets proposals?

a. The Council of Economic Advisors. b. The Office of Management and Budget. c. The Congressional Budget Office. d. The House and Senate Budget Committees.

Reducing business taxes or providing specific investment incentives can shift the demand for loanable funds curve

a. rightward, slow the growth of the capital stock, and improve the standard of living b. rightward, speed the growth of the capital stock, and improve the standard of living c. leftward, speed the growth of the capital stock, and reduce the standard of living d. rightward, speed the growth of the capital stock, and reduce the standard of living e. leftward, slow the growth of the capital stock, and reduce the standard of living

When the amount of sales is large, but each sale has a low value, cheating on a cartel arrangement can significantly increase an individual firm's profits and is thus tempting

a. True b. False Indicate whether the statement is true or false

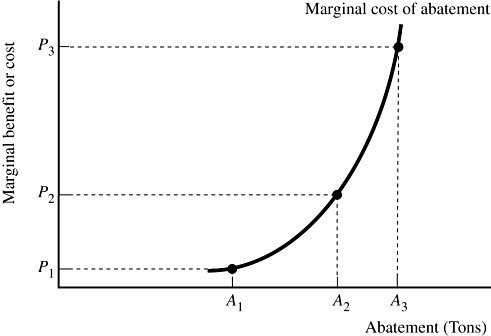

Figure 16.1A firm that generates pollution is illustrated in Figure 16.1. The government has chosen to impose a pollution tax equal to P2. From the firm's point of view, the marginal benefit of abatement is:

Figure 16.1A firm that generates pollution is illustrated in Figure 16.1. The government has chosen to impose a pollution tax equal to P2. From the firm's point of view, the marginal benefit of abatement is:

A. avoiding the pollution tax imposed by the government. B. the positive publicity the firm will receive by having a "green" production plant. C. the reciprocal of the marginal cost of abatement. D. zero because abatement benefits the general public, not the firm.