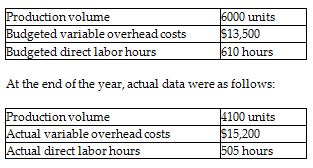

Stafford Company uses standard costs for its manufacturing division. Standards specify 0.1 direct labor hours per unit of product. The allocation base for variable overhead costs is direct labor hours. At the beginning of the year, the static budget for variable overhead costs included the following data:

How much is the standard cost per direct labor hour for variable overhead? (Round your answer to the nearest cent.)

A) $22.13 per direct labor hour

B) $32.93 per direct labor hour

C) $26.73 per direct labor hour

D) $24.92 per direct labor hour

A) $22.13 per direct labor hour

Explanation: Standard direct labor cost per hour = $13,500 / 610 hours = $22.13 per direct labor hour

You might also like to view...

When speakers make an effort to avoid errors in reasoning, they demonstrate which of the following elements of persuasion?

A) logos B) ethos C) slippery slope D) pathos

Which of the following is not a problem usually associated with the flat-file approach to data management?

a. data redundancy b. restricting access to data to the primary user c. data storage d. currency of information

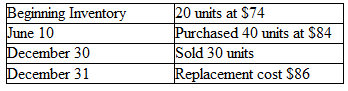

The company maintains its records of inventory on a perpetual basis using the FIFO inventory costing method. Calculate the amount of ending Merchandise Inventory at December 31, 2018 using the lower-of-cost-or-market rule.

Boulevard Home Furnishings had the following balances and transactions during 2018.

Why is a firm's organizational climate an important part of building a successful sales staff?

What will be an ideal response?