What is the federal funds rate? What are the main determinants of the federal funds rate?

What will be an ideal response?

The federal funds rate is the interest rate banks charge for overnight loans. Banks may lend excess reserves in order to earn interest. Banks may borrow reserves in order to meet their reserve requirement or meet their customer’s need for money. Demand for reserves is based on several variables. As federal funds increases, for example, the opportunity cost of holding excess reserves increases and banks will want to lend out more reserves (as opposed to holding these reserves). The demand for reserves is based on the reserve requirement, the price level, and income. If the price level rises, people and businesses need to hold more money to carry out the same purchases of goods and services. If income rises, people spend more and need money to carry out these transactions. Either of these would lead to an increase in the federal funds rate as reserves become more scarce.Reserves supply is affected by the Fed’s monetary policy, especially its use of open-market operations. For example, an open-market purchase increases the supply of reserves banks have available, causing a decrease in the federal funds rate.

You might also like to view...

Which of the following would be considered open-access common property?

A) a library B) the world wide web C) a company gym D) broadcast television

In contrast to neoclassical growth theory, new growth theory lays more emphasis on

A) intangibles than tangibles. B) tangibles than intangibles. C) changes in the money supply than changes in taxes. D) fiscal policy than monetary policy. E) objects than ideas.

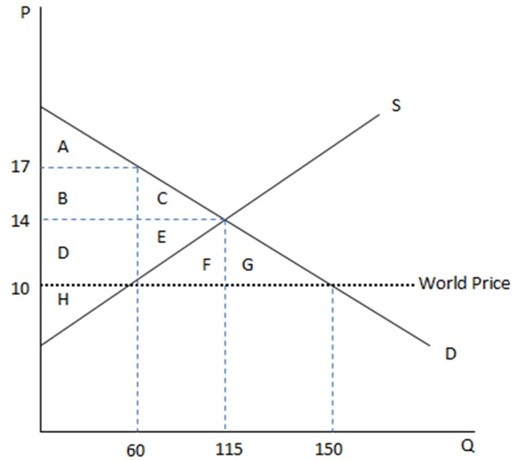

This graph demonstrates the domestic demand and supply for a good, as well as the world price for that good. According to the graph shown, if this economy were an autarky, producers would enjoy area:

According to the graph shown, if this economy were an autarky, producers would enjoy area:

A. ABC. B. H. C. HDE. D. A.

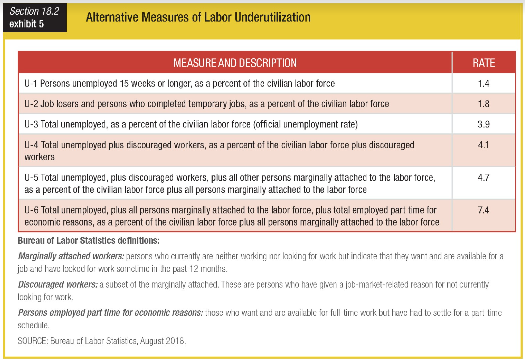

Which of the following groups is considered a subset of marginally attached workers?

a. discouraged workers

b. job losers and persons who completed temporary jobs

c. persons unemployed 15 weeks or longer

d. persons employed part time for economic reasons