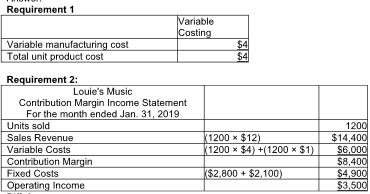

Requirements 1. Compute the product cost per harmonica produced under variable costing. 2. Prepare an income statement for January, 2019

Louie's Music produces harmonicas that it sells for $12 each. The company computes a

new monthly fixed manufacturing overhead allocation rate based on the planned number

of harmonicas to be produced that month. Assume all costs and production levels are

exactly as planned. The following data are from Louie's Music's first month in business:

You might also like to view...

Country-of-origin effects refer to the attitude anything produced by the home country is better than imported goods

Indicate whether the statement is true or false

________ project management concentrates firmly on thorough planning up front.

Fill in the blank(s) with the appropriate word(s).

The Ford Motor Company has entered into an alliance with Yves Saint Laurent, a maker of clothing and one of the most successful fashion houses in the world. Yves Saint Laurent is headquartered in France. Ford will use Yves Saint Laurent designs and color traditions in its production of luxury models of the company's Expedition SUV and Lincoln vehicles. The Yves Saint Laurent elements will appear in the interior and body paint color. This alliance would most likely be classified as

A. a strategic alliance. B. a joint venture. C. a global direct ownership. D. a multinational enterprise. E. contract manufacturing.

______ leaders are unable to accept new ideas.

A. Callous B. Rigid C. Abusive D. Incompetent